st louis county personal property tax rate

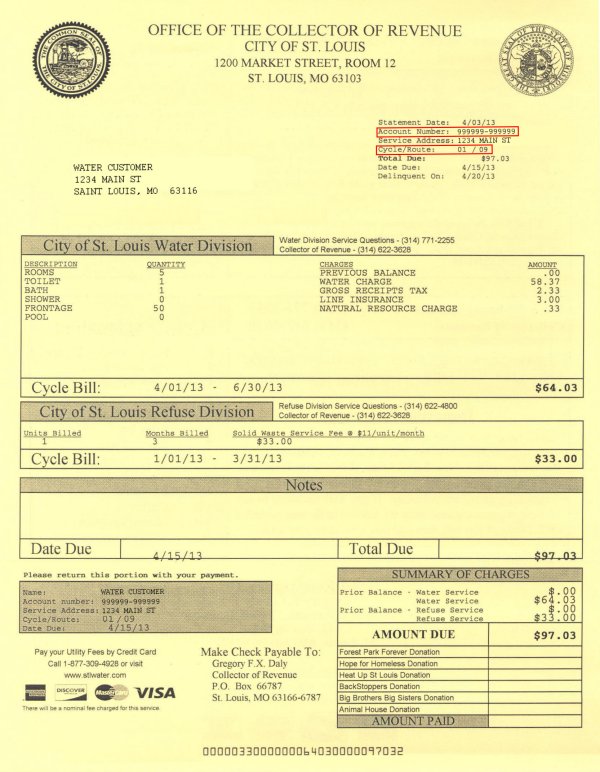

The median property tax in Missouri is 126500 per year for a home worth the median value of 13970000. Account Number or Address.

St Louis County Warns Of More Flash Flooding From Overnight Rain

The median property tax in St.

. The following is a list of property tax rates in Missouri. Account Number number 700280. The Census Bureau ranks Lawrence County as 31st in population in Missouris listing of 114 counties and the City of St.

03870 per 100 Assessed Valuation Residential Real Property Tax Rate. How Much Is Property Tax In St Louis. Anyone with delinquent real or personal property taxes in St.

Mo dao zu shi download eng sub big nate movie. The Personal Property Department collects taxes on all motorized vehicles boats recreational vehicles motorcycles and business property. November 15th - 2nd Half Agricultural Property Taxes are due.

Monday - Friday 8 AM - 5 PM. If your taxes are delinquent you will need to contact the County Auditor at 218-726-2383 to obtain the correct amount to pay. Louis County is 223800 per year based on a median home value of 17930000 and a median.

Louis County Commercial Real Estate has an. Where Can I Pay My Personal Property Tax In St Louis County. Louis County Missouri is 2238 per year for a home worth the median value of 179300.

03340 per 100 Assessed Valuation St. Louis County Missouri is 2238 per year for a home worth the median value of 179300. November 15th - 2nd Half Manufactured Home Taxes are due.

Personal Property Tax Department. Personal Property Tax Rate. October 17th - 2nd Half Real Estate and Personal Property Taxes are due.

November through December 31st you may also drop off. Louis County collects on average 125 of a propertys. Personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later than December 31 each year.

Property Just Now Obtain a Personal Property Tax Receipt - St. The effective property tax rate in the state is 093 which is slightly lower than the. To declare your personal property declare online by April 1st or download the printable forms.

41 South Central Avenue Clayton MO 63105. Account Number number 700280. St Louis County Personal Property Receipt.

Louis County website and click on the Pay Taxes link. If you are interested in purchasing tax -forfeited property. Property 7 days ago Collector - Real Estate Tax Department.

August 31st - 1st Half Manufactured Home Taxes. Louis County collects on average 125 of a propertys. Counties in Missouri collect an average of 091.

The value of your personal property is assessed. Account Number or Address. Louis County personal property tax can be paid online by mail or in person.

The median property tax in St. City Hall Room 109. To declare your personal property declare online by April 1st or download the printable forms.

Monday - Friday 800am - 500pm. To pay online go to the St. May 16th - 1st Half Real Estate and Personal Property Taxes are due.

Tax amount varies by county. May 16th - 1st Half Agricultural Property Taxes are due. Louis County is prohibited from purchasing state tax -forfetied land.

The median property tax also known as real estate tax in St.

How Do You Know If You Qualify For The Missouri Property Tax Credit

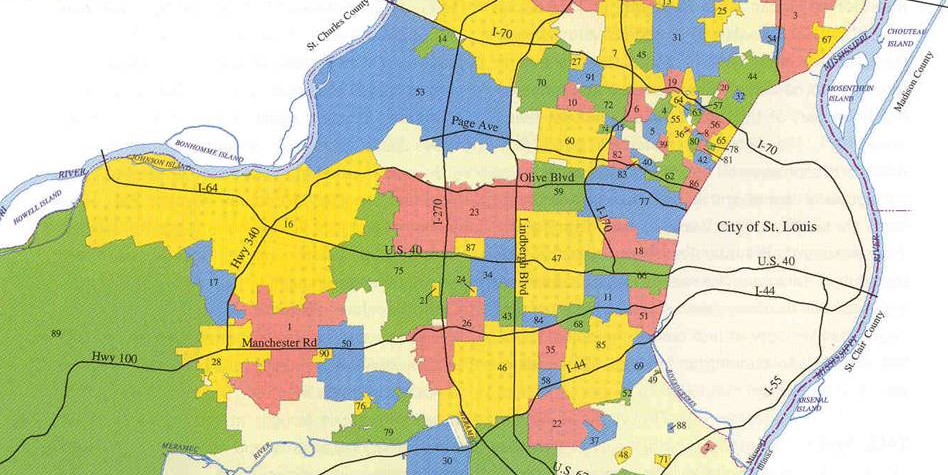

Opinion How Municipalities In St Louis County Mo Profit From Poverty The Washington Post

County Assessor St Louis County Website

Curious Louis Why Do Missourians Have To Pay Personal Property Taxes Stlpr

Clay County Missouri Tax A Resource Provided By The Collector And Assessor Of Clay County Missouri

Online Payments And Forms St Louis County Website

Let It Go Time To Disincorporate Municipalities In St Louis County Nextstl

10 Best St Louis Suburbs Trendy Suburb Of St Louis Mo Map 2022

St Louis County Voters To Weigh Whistleblower Protections Other Ballot Measures

Collector Of Revenue St Louis County Website

Online Payments And Forms St Louis County Website

St Louis County Missouri St Louis County Website

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

How To Use The Property Tax Portal Clay County Missouri Tax